P/E, or Price-to-Earnings ratio, is one of the most well-known and widely used indicators in investment analysis. This ratio tells us how much investors are willing to pay for one unit of a company’s earnings. Let’s explain what P/E exactly means, why it’s important to monitor, and how to use it in trading, especially swing trading.

What is P/E?

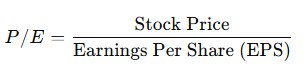

The P/E ratio is calculated as:

For example, if a stock price is $100 and the earnings per share is $5, then the P/E is 20. This means investors pay $20 for every $1 of the company’s earnings.

What is P/E Good For?

- Valuing the stock: P/E shows whether a stock is relatively expensive or cheap compared to its earnings.

- Comparing companies: It helps compare valuations of different companies within the same industry.

- Market expectations: A higher P/E often means the market expects faster earnings growth, while a lower P/E may indicate slower growth or company issues.

Why Include P/E in Your Analysis?

P/E is a useful indicator that complements technical analysis and other fundamental metrics. It helps traders understand the context of a stock price and its potential:

- Helps identify overvalued or undervalued stocks.

- Allows better estimation of whether the current stock price is sustainable.

- Supports entry or exit decisions in swing trading.

What P/E is Suitable for Trading?

Ideal P/E values vary by industry and market conditions, but generally:

- Low to moderate P/E (e.g., 10–20): Often considered healthy, indicating a stable company at a reasonable price.

- High P/E (> 25–30): May reflect expectations of strong growth but also higher risk of overvaluation.

- Very low P/E: May signal company problems or market distrust.

For swing trading, it’s often better to choose stocks with reasonable P/E ratios to reduce the chance of sharp declines.

What to Avoid?

- Ignoring context: P/E alone isn’t enough; it should be combined with other indicators and company information.

- Comparing across industries: P/E in tech can be very different from industrials, so compare companies within the same sector.

- Extremely low or high values: These can be warning signs of risk or unrealistic expectations.

Summary

P/E is a simple but powerful metric that should not be missing from any trader’s or investor’s analysis. Proper understanding and use of P/E help better evaluate stocks and plan trades with lower risk, especially in swing trading.