After understanding winrate, another key building block of profitable trading is the so-called Risk/Reward Ratio (RRR). This indicator tells you how much you are willing to risk on a single trade compared to what you can potentially gain. In this article, we will explain in detail what RRR is, how it is calculated, when you are profitable, and why this ratio is crucial for long-term trading success.

What is the Risk/Reward Ratio?

The Risk/Reward Ratio (RRR) expresses the ratio between potential loss and potential gain on a single trade.

Formula:

RRR = Potential Loss / Potential Gain

For example:

You risk 1000$ and aim for a profit of 3000$. RRR = 1000 / 3000 = 1:3

You risk 500$ and aim for a profit of 500$. RRR = 1:1

Why is RRR important?

This ratio is important for:

- Managing risk per trade — you know exactly how much you can lose at most and how much you expect to gain.

- Planning your trading strategy — it lets you decide in advance if a trade is worth taking.

- Trading psychology — knowing that even with losses you remain profitable helps you trade more calmly.

When am I profitable and when am I losing?

Profitability depends not only on winrate but also on RRR. For example:

- With a 50% winrate and 1:1 RRR you break even.

- With a 40% winrate and 1:2 RRR you are profitable.

- With a 60% winrate and 1:0.5 RRR you are still profitable.

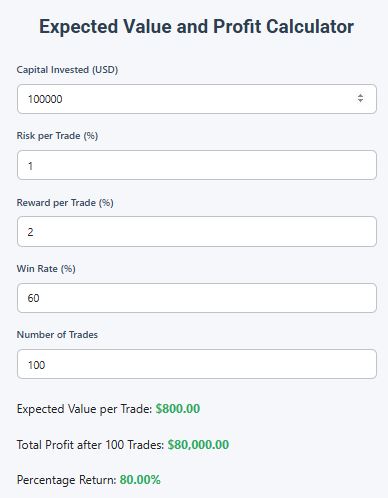

Expected value (EV) formula:

EV = (Winrate × Win) – (Lossrate × Loss)

If EV > 0, the strategy is profitable. If EV < 0, it is losing.

Practical example

Trader A:

- Winrate: 50%

- Risks 1000$ per trade

- Target profit: 2000$ (RRR 1:2)

Out of 10 trades:

5 wins × 2000$ = 10,000$

5 losses × 1000$= 5,000$

Total profit = 5,000$

Trader B:

- Winrate: 70%

- RRR: 1:0.5 (risks 1000$, gains 500$)

Out of 10 trades:

7 wins × 500$= 3,500$

3 losses × 1000$ = 3,000$

Total profit = 500$

Even strategies with lower profit per trade can be profitable thanks to higher winrate.

How to choose the right RRR

- Beginners are recommended to use at least 1:1 RRR.

- Advanced strategies can use higher RRR (e.g., 1:2 or 1:3), even with a lower winrate.

- Consistency is key — avoid adjusting your trading plan emotionally.

Conclusion

The Risk/Reward Ratio is a fundamental tool for risk management. It helps you assess whether a trade makes sense and how much loss you are willing to accept relative to the potential gain. Properly setting your RRR combined with a suitable winrate gives you a high chance of long-term success. In the next article, we will look at expected value — a key number that combines these two factors and determines if a trading strategy truly makes money.

Trading Mathematics Miniseries

Winrate: A Key to Understanding the Success of a Trading Strategy

Expected Value in Trading: What It Is and Why You Need to Know It

How Can You Make Money With a 60% Win Rate and 1:1 RRR? A Practical Example With 100 Trades

How to Improve Winrate: 10 Specific Ways to Increase Your Trade Success Rate

What Do Successful Traders Do Differently? They Have Risk Management