In price action trading, the impulsive move is one of the most important concepts. It refers to a strong and rapid price movement in one direction, which can signal the start of a new trend or confirm the strength of the current market direction. Understanding impulsive moves helps you time entries better, identify strong levels, and manage risk more effectively.

What is an Impulsive Move?

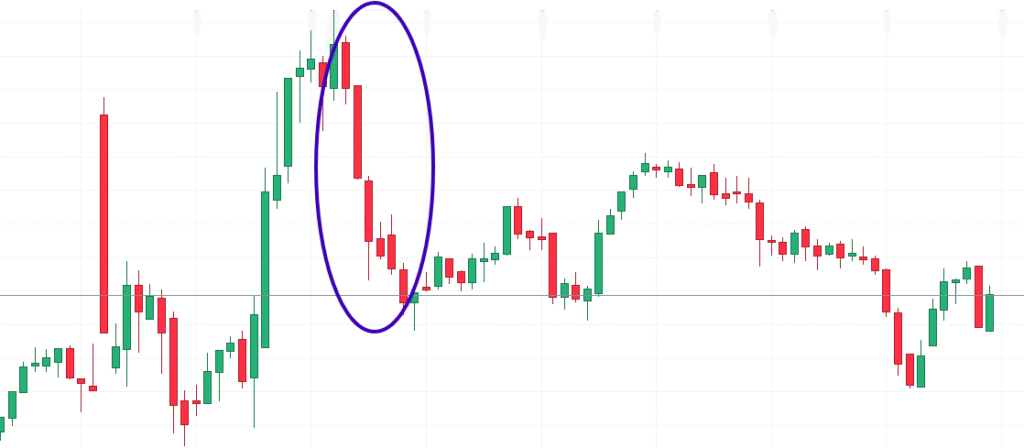

An impulsive move is a situation where the market moves quickly and decisively in one direction — either up or down — without significant pullbacks. This movement is typically accompanied by:

- large candlesticks with minimal wicks,

- increased trading volume,

- breakout of key levels (support/resistance),

- often followed by a correction or consolidation.

An impulsive move indicates that one side of the market — either buyers or sellers — is clearly dominant, and the opposing side has no strength to stop the move.

Who or What Causes Impulsive Moves?

Impulsive moves don’t happen randomly. They’re usually triggered by specific participants or market conditions:

1. Institutional Investors (Smart Money)

Large players such as banks, investment firms, and hedge funds have access to enormous capital. When they enter the market with high volume, they create an imbalance between supply and demand, causing price to move sharply — an impulsive move.

Example: A fund buys thousands of S&P500 contracts → price jumps rapidly.

2. Algorithmic and High-Frequency Trading (HFT)

Modern markets are heavily influenced by algorithms reacting to market data in milliseconds. When these algorithms detect a signal to enter the market, they often do so in waves, creating strong impulsive moves.

3. News and Fundamental Events

Macroeconomic releases (e.g., interest rate decisions, inflation data, unemployment rates), earnings reports, or geopolitical shocks can trigger immediate market reactions. Traders respond quickly and often impulsively — causing strong price movement.

Example: The FED raises rates more than expected → USD strengthens sharply.

4. Retail Position Liquidation (Stop Loss Hunting)

When price reaches a zone where many retail traders have placed stop losses, it can trigger a wave of automatic buy/sell orders. This results in a rapid price movement — a liquidity grab — creating an impulsive move.

5. Low Liquidity

During low-volume periods (e.g., overnight, weekends) or on less-traded assets, even small orders can cause significant price movement.

Impulsive vs. Corrective Move

Every impulsive move is usually followed by a corrective move – a slower, more hesitant price pullback. Traders often use these corrections to enter positions in the direction of the original impulsive move (so-called “buy the dip” or “sell the rally”).

How to Use Impulsive Moves in Trading

- Identify breakouts with impulsive strength – e.g., from consolidation zones.

- Watch volume and candlestick size – the bigger they are, the stronger the confirmation.

- Enter after a correction – a more conservative strategy with lower risk.

- Always use proper risk management – impulsive moves are fast, but can also quickly reverse.

Conclusion

Impulsive moves are a key signal in price action analysis. They are caused by big players, algorithms, or fundamental events. If you learn how to recognize impulsive moves and understand their origin, you’ll gain a major advantage in timing your trades and managing your capital effectively.