When trading financial markets, we often encounter various indicators and metrics that help us evaluate our strategies and decisions. One of the most essential concepts every trader should know is Expected Value (EV). This term comes from probability theory and statistics, but in trading, it plays a key role in assessing whether a strategy is profitable in the long run.

What is Expected Value?

Expected Value is basically the average profit or loss you can expect per trade if you repeat the strategy many times in a row. In other words, it shows whether your trading system is set up to lead you to profit or loss over the long term.

If the Expected Value is positive, it means your strategy should generate profit on average over many trades. If it is negative, it means you are likely losing money in the long run.

Why Do You Need to Know Expected Value?

Many traders focus only on winrate — how often they win — or on the size of profits and losses. However, this is a limited view. Without understanding Expected Value, a trader can easily make wrong decisions, such as:

- A strategy with a high winrate but a low risk/reward ratio can be losing money in the long term.

- A strategy with a low winrate but a high risk/reward ratio can be very profitable.

Using Expected Value allows you to objectively compare different strategies and decide which one is right for you.

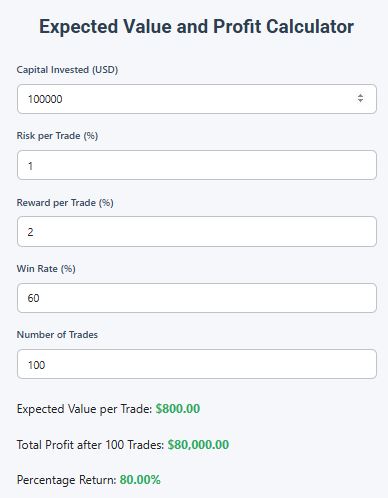

How to Calculate Expected Value?

The formula for Expected Value is:

Where:

- Pwin is the probability of winning (winrate in decimal form, e.g., 0.6 for 60%)

- Ploss=1−Pwin is the probability of losing

- Average profit is the average amount gained on winning trades

- Average loss is the average amount lost on losing trades

The result tells you how much you can expect on average per trade — it can be positive (profit) or negative (loss).

Practical Examples

Example 1: Strategy with High Winrate but Low Risk/Reward

- Winrate: 80% (Pwin=0.8)

- Average profit: 500 $

- Average loss: 1000 $

- Probability of loss: Ploss=0.2

Calculate EV:

EV=(0.8×500)−(0.2×1000)=400−200=200 $

Even though losses are larger than profits, thanks to the high winrate the strategy is still profitable, earning on average 200 $ per trade.

Example 2: Strategy with Low Winrate but High Risk/Reward

- Winrate: 40% Pwin=0.4)

- Average profit: 3000 $

- Average loss: 1000 $

- Probability of loss: Ploss=0.6

Calculate EV:

EV=(0.4×3000)−(0.6×1000)=1200−600=600 $

This strategy has a lower success rate but, due to a high risk/reward ratio, it earns more on average than the first example.

How to Use Expected Value in Practice?

- Evaluate your strategies — calculate EV based on historical data and decide if your strategy is profitable in the long run.

- Test new approaches — when testing new methods, compare their EV and choose those with positive Expected Value.

- Risk management — combine EV with other indicators like position size or maximum allowable loss to keep your trading stable and sustainable.

- Trading psychology — understanding EV helps you accept losses better and avoid emotional decisions, knowing that even with losing trades you are profitable in the long run.

Conclusion

Expected Value is an essential tool for every trader who wants to trade with a clear strategy and plan. It provides an objective number showing whether a given approach is sustainable and profitable in the long term. Learn to use EV, compare your strategies, and keep your trading on solid ground. Without knowledge of Expected Value, trading is more gambling than a systematic way to make money in the markets.

Trading Mathematics Miniseries

Winrate: A Key to Understanding the Success of a Trading Strategy

Risk/Reward Ratio: How to Properly Balance Risk and Reward

How Can You Make Money With a 60% Win Rate and 1:1 RRR? A Practical Example With 100 Trades

How to Improve Winrate: 10 Specific Ways to Increase Your Trade Success Rate

What Do Successful Traders Do Differently? They Have Risk Management