In intraday and swing trading, we often encounter the term winrate. This simple yet fundamental metric tells us how often our trades end in profit. While it may seem straightforward, its meaning is much deeper. In this article, we’ll take a closer look at what winrate really is, why it matters, and how to use it effectively in practice.

What Is Winrate?

Winrate, or the winning trade ratio, is the percentage of profitable trades out of the total number of executed trades.

Formula:

Winrate (%) = (Number of Winning Trades / Total Number of Trades) × 100

For example, if you make 100 trades and 60 of them are profitable, your winrate is 60%

Why Is Winrate Important?

Winrate is a cornerstone when it comes to evaluating a trading strategy. It helps us understand:

- How reliable our strategy is – A strategy with an 80% winrate means we’re winning most of our trades.

- The psychological demands of trading – A strategy with a low winrate, for example 30%, means that most trades will end in a loss. This can be mentally challenging for many traders, even if the strategy is profitable in the long run.

- The need to combine winrate with Risk/Reward Ratio (RRR) – A high winrate doesn’t automatically guarantee profit. It must be paired with the size of the gain per winning trade and the size of the loss per losing trade.

High vs. Low Winrate

- High Winrate (e.g., 70–90%) – This often means the strategy takes smaller profits but more frequently. These strategies usually have a lower RRR (e.g., 1:0.5 or 1:1).

- Low Winrate (e.g., 30–40%) – This can still be highly profitable if you have a high RRR (e.g., 1:3 or higher).

A Practical Example

Let’s look at two traders:

Trader A:

- Winrate: 80%

- Risk/Reward: 1:0.5 (risks 1000 $, earns 500 $)

- Number of trades: 10

Results:

8 wins: 8 × 500 $= 4000 $

2 losses: 2 × 1000 $= 2000 $

Total profit: 2000 $

Trader B:

- Winrate: 40%

- Risk/Reward: 1:3 (risks 1000 $, earns 3000 $)

- Number of trades: 10

Results:

4 wins: 4 × 3000 $= 12,000 $

6 losses: 6 × 1000 $= 6000 $

Total profit: 6000 $

Despite having only a 40% winrate, Trader B’s strategy made more profit. This brings us to an important point: winrate should never be evaluated in isolation.

Winrate in Combination with Risk/Reward

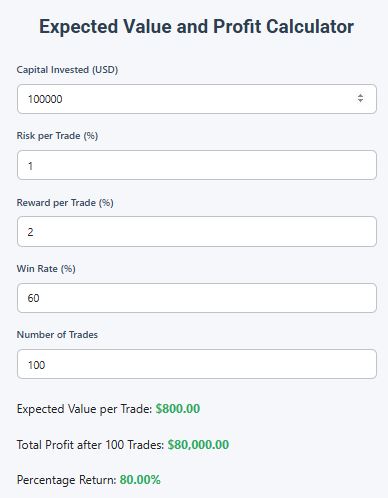

To be a profitable trader, a high winrate is not enough. You also need the right combination with your risk/reward ratio. The key formula here is expected value:

EV = (Winrate × Average Win) – (Lossrate × Average Loss)

This formula tells you whether your strategy is profitable on average per trade. If the expected value (EV) is positive, you have a profitable strategy.

How to Improve Your Winrate

- Refine entry signals – Better-timed entries increase your chances of success.

- Don’t underestimate exits – Sometimes it’s better to close a trade early instead of waiting for TP or SL.

- Stick to your trading plan – Emotional decisions often lower your winrate.

- Backtest your strategy – Testing on historical data helps identify weaknesses and improve decision-making.

Conclusion

Winrate is a valuable metric that tells you how often you succeed. But it’s not enough on its own – you must always assess it alongside your risk/reward ratio and expected value. A trading strategy with a low winrate can be highly profitable if the potential profit outweighs the risk. If you want to be successful in the long run, focus not just on how often you win, but also on how much you win and the overall context of your strategy.

In the next article, we’ll take a closer look at Risk/Reward Ratio – another essential building block of successful trading.

Trading Mathematics Miniseries

Risk/Reward Ratio: How to Properly Balance Risk and Reward

Expected Value in Trading: What It Is and Why You Need to Know It

How Can You Make Money With a 60% Win Rate and 1:1 RRR? A Practical Example With 100 Trades

How to Improve Winrate: 10 Specific Ways to Increase Your Trade Success Rate

What Do Successful Traders Do Differently? They Have Risk Management