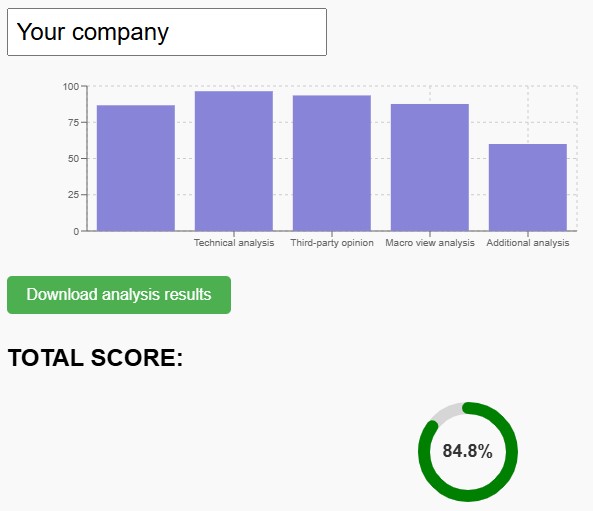

Build your own stock analysisGet your own investment opinion — with interactive checklists

Is fundamental or technical analysis more important? Should you listen to analysts, follow social media sentiment, or focus on the company’s sector? The truth is — no single factor is enough. Smart investment decisions come from a broad perspective, and that’s exactly what Decameron.io helps you build. With our interactive checklist, you'll go through key questions that cover everything from hard numbers to market sentiment. In the end, you’ll get a clear score and your own opinion — based not on hype or emotion, but on a structured, logical approach. Invest smarter. Analyze stocks with a wider lens.

If you're looking for a simple and quick way to succeed in the stock market, you're in the wrong place.

But if you're not looking for shortcuts and you're willing to invest your time in data collection, analysis, and decision-making, then you're in the right place.

Which one will you choose — the blue pill or the red pill?

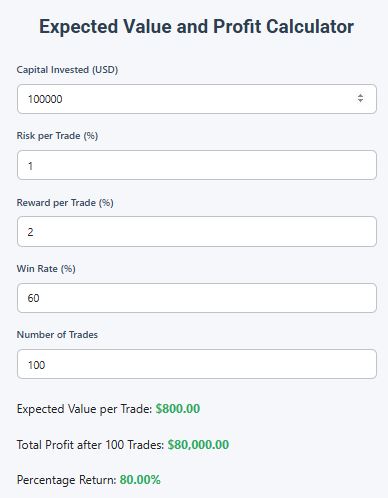

Expected Value and Profit Calculatorfor swing and intraday trading

Expected Value & Profit Calculator Quickly see if your strategy is profitable in the long run. Enter your win rate, risk-reward ratio, and number of trades — and instantly get the numbers behind your edge. A must-have tool for smart, data-driven traders.